Yes, there are workshops available for employees to enroll in to help them achieve an understanding of their collective bargaining units. Workshops to acquire an understanding of your collective bargaining unit are planned in advance. These workshops are also attended by CSUEU union representatives - they are available to answer your questions. The dates for these workshops can be found on the Training & Professional Development website. You will need to register online to attend these workshops.

-

Are there workshops available to employees regarding our collective bargaining units?

-

How do I set up my Humboldt email account?

You will need to complete the Account Activation Checklist prior to accessing email and other computer accounts. From there you will need to log on to Webmail and put in your Humboldt user name (e.g., Abc123) and one time password. From here, Webmail will promopt you on getting your email account set-up. If you have difficulties getting your email set-up, you may contact the Humboldt Help Desk at 707-826-4357 for further assistance.

-

How often are employees paid?

Staff and faculty members are issued warrants once a month. Warrants can be picked up in the SBS building, room 285.

-

If I feel there is a threat to my health and safety in my place of work, who would I contact?

If you feel that there is a threat to your health and safety please conact your supervisor or the Environmental Health and Safety department at extension 5711 immediately. Also please submit the safety/suggestion form online as soon as possible.

-

Is Direct Deposit available to employees?

Yes, Direct Deposit is available to employees. To enroll, complete the Direct Deposit Enrollment Authorization Form and return the form to the Payroll office for processing. ONce your form has been received it will take effect in approximately 45 days.

-

What holidays are given off to employees?

There are a total of fifteen holidays throughout the year. The full comprehensive list of holidays can be viewed on the Green and Gold Calendar.

-

When do I receive my paycheck?

New employees will receive their warrants (not paychecks) at the end of the month. Under certain circumstances, new employees will receive their first warrant at the beginning of the month following their hire date. Warrants can be picked-up at the Student Financial Services office located in the SBS building, room 285.

-

Where can I get a schedule regarding the employee pay schedule?

The employee pay schedule is listed on the Green and Gold Calendar.

-

Where can I go to familiarize myself with the Humboldt campus?

To familiarize yourself with the Humboldt campus, you are welcome to sign-up for a campus tour. There tours are offered year round Monday through Friday from 10:00 AM to 2:00 PM. The weekend tour is offered on Saturdays at 12:00 PM. To schedule a tour to familiarize yourself with the campus, please call 707-826-6270 or visit the Admissions Office. You can also download a campus map online to help you navigate around the Humboldt campus.

-

Where can I purchase my parking permit?

Parking permits can be purchased at the Cashier's window located in the Student Business Servicess (SBS) building on the second floor. New employees must provide the Cashier's office with their bargaining unit (see appointment letter for bargaining unit information or call Human Resources at 707-826-3626) and time-base (e.g., full-time, half-time, etc.)

-

Where do I pick up my office keys?

Please refer to the Key/Access Card Questions on the Facilities Management website.

-

Where do I receive my Humboldt identification number?

Your Humboldt identification number is created for you upon time of hire. You will receive your number on your first day of work.

-

Where do I receive my staff or faculty identification card?

Human Resources will provide new employees with an ID request form. Once new employees receive this form, they can take it to the library to have their photograph taken. ID's are usually available within five minutes.

-

Where is the Payroll Department located?

The Payroll Department is located in the Student and Business Services building, room 327. They can also be reached at 707-826-3736 Monday through Friday from 8:00 AM to 5:00 PM.

-

*What is e-Benefits?

To facilitate your open enrollment changes, Employee Self Service e-Benefits is available 24/7. e-Benefits automates and simplifies the process of managingyour benefit elections while reducing paper usage.

-

Are all CSU retirees eligible for retirement health benefits?

No. You must retire within 120 days of your separation from employment; have been eligible for enrollment in a CalPERS medical plan (or flex cash) on your date of separation; and receive a retirement allowance from CalPERS.

-

Are extended education courses available through the Fee Waiver Program?

No, extended education courses are not covered through the Fee Waiver Program. However, many extended education courses are cross‐listed as regular University courses.

-

Are there counseling services available to employees when they are experiencing family, marital, psychological, chemical, and work related problems?

Yes, Humboldt does offer couseling services for employees through the EAP program. These services are confidential and at no cost to the employee. To receive assistance please contact Paula Nedelcoff at 707-443-7358.

-

Are there professional development courses available to employees?

Yes, the CSU offers online professional development courses to all employees for free through our online portal, Skillport. To learn more and find , please visit Humboldt's training site at https://training.humboldt.edu

-

Are there training sessions available to employees for software programs used in the offices at Humboldt?

Yes, there are live and online classes that cover a wide range of topics including PeopleSoft, Human Resources, Data Warehouse/Hyperion, Environmental Health and Safety, Student Disability, Web Development and more. These live classes are scheduled in advance and can be viewed at the Training and Professional Development site.

We also have access to thousands of courses, certifications, and other resources on our learning portal, Skillport. Please visit the Training and Professional Development site where you will find a direct link to Skillport.

-

As a retiree can I change medical plans and add/delete dependents? How? When?

Yes. You may change your medical plan and add/delete dependents by contacting CalPERS at (888) 225-7377 during the annual CalPERS Open Enrollment period or within 60 days of a qualifying status change.

-

Can I change my dental plan and add/delete dependents? How? When?

You can change your dental plan and add/delete dependents during the annual open enrollment period or within 60 days of a qualifying status change.

-

Can I transfer the Fee Waiver Program benefit to someone else?

The Dependent Fee Waiver Program allows eligible employees to transfer their benefit to a spouse, domestic partner or dependent child, in lieu of participation by the employee, subject to the following conditions:

- Spouse, domestic partner or dependent child must be a regularly‐admitted student pursuing (matriculated toward) a degree or credential;

- The course(s) enrolled in on a fee‐waiver basis must be for credit toward the degree or credential requirements;

- The administration determines that there is space available in such course offerings for the spouse, domestic partner or dependent child;

- Employees in class E99 are not eligible to transfer this benefit

-

Can two of my dependents share the Fee Waiver Program benefit?

Only one person is eligible per semester. You may, however, alternate the benefit between your dependents each semester.

-

Fee Waiver Program: Can I take time off of work to attend classes?

Yes, an employee may be granted reasonable release time for one course per semester that is taken through the Fee Waiver Program, provided that the supervisor determines that the operational needs of the department will be met. It may be necessary to arrange an alternative work schedule to satisfy the operational needs of the department.

-

Fee Waiver Program: How many classes or units may I enroll in?

The Fee Waiver program allows participants to enroll in a maximum of two classes or six units per semester, whichever is greater. If the individual is taking more than the maximum number of courses or units allowed through the fee waiver program, he/she will be required to pay the difference between the part‐time State University Fee and the full‐time State University Fee along with any other associated fees.

-

Fee Waiver Program: what fees are waived or reduced?

The fees that are waived or reduced are specific to your bargaining unit or employee class. The part‐time State University Fee is waived for all fee waiver program participants. In addition, the application fee is waived if the fee waiver participant is applying for admission to the University as a regular (matriculated) student during that term.

For the list of fees assessed by Cal Poly Humboldt, please visit the fee section here:

-

For the Fee Waiver Program, what defines a dependent child?

For the fee waiver program, a Dependent Child must be one of the following:

- Child or stepchild who has never been married and is under age 25 (age 23 for Units 1, 8, and 10) through at least mid-point of the semester

- Child living with employee in a parent-child relationship who is economically dependent upon employee, who has never been married, and is under age 25 (age 23 for Units 1, 8, and 10) through at least mid-point of the semester

- Child or stepchild age 25 (age 23 for Units 1, 8, and 10) or above who is incapable of self-support due to a disability which existed prior to age 25 (age 23 for Units 1, 8, and 10).

-

How can I see what plan(s) I am currently enrolled in?

At any time of year you can find your benefits summary on the MyHumboldt portal by clicking View Paycheck and Benefits, then View Benefits

-

How do I access e-Benefits?

You can log in to e-Benefits from any computer with Internet access beginning during Open Enrollment. Once logged into MyHumboldt, navigate to the Open Enrollment link on the main page.

-

How do I select a retirement date?

The selection of your retirement date is one of the most important decisions to make when planning your retirement.

- The first factor to consider is the calculation of service credit. Based on full time employment, you earn a full year of service credit when you have worked for 10 months during a fiscal year (calculation is prorated for part time service). If you are appointed less than full time you will continue to accrue service credit up to 12 months. You may only accrue up to 1.0 service credit per fiscal year. Any unused sick leave may be converted to service credit (2,000 hours equals one year).

- The second factor to consider is your age. The calculation of the age factor for your retirement benefit increases each quarter year from your birthday at age 50 or 52, depending on your retirement tier. The benefit factor will remain constant at age 63 or 67, again depending on your retirement tier. Please see the retirement tier charts at www.calpers.ca.gov

- The third factor affecting your retirement benefit is average salary, computed on the basis of your highest 12 months of earned salary (36 months if hired after January 2011). The amount of salary will be reduced by a Social Security factor. (Final compensation minus $133.33)

- Another aspect of choosing a retirement date is the following:

Do you want to retire mid-semester, the end of the academic year, the end of the calendar year, the end of the fiscal year, the end of the pay cycle, or on your birthday? Whether you are staff or instructional faculty will also have a bearing on your decision.

For example:- Staff employees will typically retire at an age quarter (usually the end of a pay cycle) or the end of the calendar year. 1

- Faculty will generally retire at the end of the spring semester or academic year (depending on an age quarter).

This decision is a personal decision you will have to make. Each date will result in varying estimate calculations.

To create a retirement estimate based on the factors of service, age and salary, see the CalPERS retirement calculator at: http://www.calpers.ca.gov and go to “online calculator”. For a more comprehensive estimate, employees are encouraged to register for a MyCalPERS account which is a secure self-service website where you may access real-time details and balances of your individual CalPERS accounts.

-

How do you sign up for the Employee Wellness Program?

To sign up for the Employee Wellness's Healthy-U Program, fill out the Humboldt release form and turn it into the Kinesiology Department in Forbes Complex 124.

-

How long may I continue coverage of visual plan after I retire?

If you enroll in the CSU Retiree Voluntary Vision Plan, you are required to maintain enrollment for a minimum period of 12 months. You will be required to maintain enrollment for the balance of the plan year in which you enroll and for 12 months in the following plan year, unless a permitting event occurs to change your enrollment. If you enroll in COBRA, you may continue coverage for up to 18 months.

-

How often do I have to submit an application for the fee waiver program?

You must submit a fee waiver application for yourself or your dependent each semester.

-

I'm currently enrolled as an active employee in a CalPERS medical plan. What do I do to obtain retiree medical coverage?

If you retire less than 30 days after your separation date from employment, your medical coverage will continue automatically. If you retire between 30 and 120 days after your separation date from employment, contact Human Resources for more information.

-

I'm currently enrolled in a dental plan? What do I do to obtain retiree dental coverage?

If your retirement date is within one pay period of your separation date from employment, coverage will be continuous. If your retirement date is more than one pay period and less than 120 days from your separation date from employment, contact HR Services for more information.

-

I'm currently enrolled in FlexCash. How do I enroll in a CalPERS retiree medical plan?

You may request coverage within 30 days before or after your retirement date. To enroll before your retirement date, contact HR Benefits. To enroll after your retirement date, contact CalPERS at (888) 225-7377. If you do not enroll within 30 days before or after your retirement date, you must wait until the next annual CalPERS Open Enrollment period to enroll unless you experience a qualifying status change.

-

I'm currently enrolled in FlexCash? How do I enroll in a retiree dental plan?

FlexCash participants may request dental coverage within 30 days before, or 60 days after the retirement date by contacting Human Resources at 707-826-5172. You also may enroll during the annual open enrollment period.

-

If both parents are employees and wish to collectively transfer their Fee Waiver Program benefits to their dependent child, how will this affect the benefit?

If both parents are employees and are eligible to transfer their fee waiver benefit, it is possible for one child to receive both benefits and be eligible to enroll in up to 4 courses or 12 units, whichever is greater.

-

If I have not established residency in CA, will my dependent or I still qualify for the Fee Waiver Program?

Yes, you or your dependent will still qualify for the Fee Waiver Program. Non-resident tuition fees may apply, unless you or your dependent is eligible through the Title 5, Section 41910 provision, to be determined at the time of admission to the fee waiver program.

-

Is the Fee Waiver Benefit taxable?

The Fee Waiver Benefit is taxable for

- domestic partners

- spouses and dependent children taking post‐baccalaureate classes

- employees taking graduate/doctoral level courses (see details below)

Beginning with the 2019 tax year (January 1, 2019 through December 31, 2019), all graduate/doctoral level courses taken by employees (job-related or Career Development Plan) that exceed the threshold of $5,250 will be considered taxable income. The taxes will be withheld in a lump sum from the employee’s pay warrant following census each semester. Census is generally mid-September for Fall term, and mid-February for Spring term on our campus. The withholding amount would likely be deducted on the following pay warrant, but it can take up to 2 months to process.

Full Time Example:*

Total value of Fee Waiver (total tuition waived in a calendar year) = $9,098

$9,098 - $5,250 (threshold) = $3,848 in tuition waived beyond the threshold

Flat Tax Rate = 36.25%

Total taxes withheld from employee’s pay warrant = $1,394.90Part Time Example:

Total value of Fee Waiver (total tuition waived in a calendar year) = $5,644

$5,644 - $5,250 (threshold) = $394 in tuition waived beyond the threshold

Flat Tax Rate = 36.25%

Total taxes withheld from employee’s pay warrant = $142.83The tax withheld for fee waiver is in addition to any other taxes the employee is subject to have withheld form their pay warrant. The Flat Tax Rate of 36.25% represents 22% federal withholding, 6.6% state withholding, and 7.65% Social Security and Medicare.

Please Note:

- Employees, in consultation with a personal income tax advisor, can evaluate whether their fee waiver qualifies for the “job related” fringe benefit exception to taxation in Internal Revenue Code § 132(d), and if applicable, claim the deduction on an individual income tax return.

- Undergraduate fees for employees will remain nontaxable pursuant to IRC § 117(d).

- Graduate/ Doctorate fees for employees will also remain nontaxable if expenses do not exceed $5,250 (in a calendar year) pursuant to IRC § 127.

*Tax Rate Information is current as of posting, June 5, 2020.

-

Is the Fee Waiver Program also accepted at UC campuses?

No, the Fee Waiver program is available for courses at CSU campuses only.

-

Is there a deadline for submission of the fee waiver or dependent fee waiver application?

Fee Waiver Forms should be submitted to Human Resources at least three weeks prior to the first day of instruction each term. Humboldt and other CSU deadlines may affect you or your dependent's ability to register for classes. For this reason, we encourage you to view the calendar of activities and deadlines at the campus of attendance.

-

Is there a fee for the Employee Wellness Program?

An employee will have to pay for fitness classes and health services offered through the Employee Wellness Program. Please visit the Kinesiology website for the prices and details on sercies and classes ofered through the program.

-

May I continue my vision coverage?

Yes, benefits eligible retirees may continue coverage by enrolling in the CSU Retiree Voluntary Vision Plan or COBRA. Enrollment information is mailed to the retiree's home address.

-

Some CalPERS plans have retiree health benefit vesting requirements. Are there any health benefit vesting requirements for CSU retirees who meet all the above eligibility rules?

No, if you meet the criteria above, you receive 100% of the state's share of your health benefit premium.

-

What are the step‐by‐step instructions for applying for the fee waiver benefit at Humboldt?

Please visit the Fee Waiver Instructions page for instructions.

-

What benefits can continue into retirement for retirees?

Medical, dental and vision coverage can continue into retirement for eligible employees and their eligible dependents. CSU-paid life insurance (if applicable) does not continue into retirement. Retirees are provided the option to convert the life insurance to an individual policy. CSU-paid LTD insurance (if applicable) ends upon separation from employment.

-

What do I do when my dependents or I become eligible for Medicare?

As a CalPERS retiree, you and/or your dependents must enroll in Medicare Part B when your reach age 65.

Do not enroll in Medicare Part D as you already have a CalPERS prescription drug plan. If you enroll in Medicare Part D, your CalPERS health plan will be canceled until you are dis-enrolled.

You and your dependents must certify your Medicare status with CalPERS when you each become eligible for Medicare and change from the Basic medical plan to a supplemental to Medicare or Managed Medicare plan at that time. Contact CalPERS at (888) 225-7377 to change your plan.

-

What do I need to do to use e-Benefits?

Employees will need to have access to PeopleSoft’s HR Center and fill out/sign the e-Benefits electronic signature form.

-

What happens if I elect COBRA and my coverage ends after 18 months?

You may enroll in the CSU Retiree Voluntary Vision Plan during any subsequent open enrollment period following your COBRA eligibility end date or COBRA cancellation due to non-payment.

-

What happens to my vacation balance when I retire?

Your vacation balance can be paid to you in a lump sum upon retirement. Employees may request to use all or part of their vacation accruals prior to their retirement date. However, please note the use of vacation time must be authorized by the manager, even if directly preceding a service retirement.

Employees who separate from employment who are otherwise eligible to cash out their vacation balance may choose to transfer a designated amount from their lump-sum separation pay into an existing Tax Deferred Retirement Savings Account (401(k)/ 403(b) and 457 plan account).

If you choose to transfer an amount into a Tax Deferred account, you will need to complete a Request to Transfer Lump-Sum Separation Pay Application and submit to the Payroll Office prior to your retirement date. Copies of the application can be obtained in the Benefits Office.

-

What happens with my dental coverage when I retire?

If you are currently enrolled in the DeltaCare Enhanced (HMO) plan your dental coverage as a retiree will be reduced to the DeltaCare Basic plan. If you are enrolled in the Delta Dental Enhanced Level II (PPO) plan your dental coverage as a retiree will be reduced to the Delta Dental Basic plan.

You can refuse enrollment in the basic dental coverage upon retirement and instead opt to continue your enhanced coverage under COBRA for up to eighteen (18) months. You pay the full cost for coverage under COBRA. Once COBRA ends, you can immediately enroll in a basic dental plan to avoid a lapse in coverage, or during any subsequent open enrollment period that follows the expiration date of COBRA coverage by contacting the CSU Chancellor’s Office for enrollment at (562) 951-4411.

-

What if I change my mind and want to change my elections?

Please reach out to benefits staff at benefits@humboldt.edu if you change your mind about your elections while still in the Open Enrollment period. Submitted elections will be finalized once Open Enrollment closes and cannot be changes after that time

-

What is the CSU Fee Waiver Program?

The California State University offers eligible employees the opportunity to enroll in the CSU Employee Fee Waiver and Reduction Program. This program provides for the waiver or reduction of certain fees for employees who enroll in work‐ related courses offered by the CSU for the purpose of improving skills for existing jobs, or advancement in accordance with a career development plan. This program also provides eligible employees with the option of transferring their fee waiver benefit to an eligible dependent.

-

What is the difference between the CSU Retiree Voluntary Vision Plan and COBRA?

The retiree plan has a three-tier monthly rate whereas COBRA has one composite premium rate for all enrollments. The retiree plan does not include the Vision Display Terminal (VDT) benefit. Otherwise the retiree plan benefits are comparable to the COBRA benefits.

-

What is the Employee Wellness Program?

The Employee Wellness Program is an on-campus program that incorporates exercise into the workplace. It works by allowing employees time to visit with the Kinesiology and Recreation departments to exercise and learn about keeping fit. Employees are also eligible to register in an array of exercise classes offered throughout the semester. The Employee Wellness Program also offers staff different health services such as the body composition analysis and aerobic fitness assessment.

-

What mandatory deductions will I pay after retirement?

You will continue to pay federal and state taxes. Social Security taxes and your contribution to CalPERS stop at retirement. You may be required to pay the Medicare tax of 1.45% of your gross retirement pay. Determining your taxation at retirement is a complex issue. You may contact CalPERS or request the booklet, "Taxation and Your Retirement" from CalPERS at www.calpers.ca.gov , or consult your tax advisor.

-

What will be the monthly out-of-pocket enrollment cost for retiree dental coverage?

Currently, CSU pays the full cost of the Basic level dental coverage for eligible retirees and their eligible dependents.

-

What will be the monthly out-of-pocket enrollment cost?

The cost to the retiree for medical coverage will depend on which plan and the level of coverage the retiree chooses.

-

When may I enroll in visual plan coverage?

Retirees may enroll in the CSU Retiree Voluntary Vision Plan at the time of retirement, within 60 days of their retirement, within 60 days of loss of coverage on another vision plan, or during any subsequent open enrollment period.

Retirees may enroll in COBRA within 60 days of their separation date from employment.

-

When will I enroll in benefits?

Employees will receive all the forms to fill out on their first day of hire. Benefits begin the first day of the month following an employee's appointment. For example, if somen is hired on May 5th, benefits will begin on June 1st if all the necessary paperwork has been returned to Human Resources.

-

Where can I find a full listing of forms for different benefits?

To find a full listing of forms ranging from health benefit enrollment forms to Whistle blower Complaint Forms, please visit the Benefits Forms page on the Human Resources section.

-

Where can I find the application forms for the Fee Waiver Program Benefit?

Please visit the Fee Waiver Program page and scroll down to the Forms section.

-

Which family members can be covered under the retiree health benefits?

Eligible dependents include spouse, domestic partner, children under age 26, and disabled children over age 26. Certain restrictions apply.

-

Who do I contact if I have questions about the Fee Waiver Program, or if I think there is a problem with how my benefit has been applied?

If you have any further questions regarding the fee waiver program, please contact:

Nancy Olson

Fee Waiver Coordinator

Human Resources

feewaiver@humboldt.edu

707-826-3626 -

Who is eligible for the Fee Waiver Program?

Eligibility for the Fee Waiver Program differs by employee bargaining unit/class (see below). Please note that employees who are on an approved full or partial leave of absence with or without pay remain eligible.

- Unit 1 (Physicians):

- All members

- Units 2, 5, 7, 9 (CSUEU), Unit 4 (Academic Professionals), Unit 6 (Skilled Trades), Unit 10 (IUOE):

- All full-time employees (i.e. permanent, temporary, and probationary)

- Part-time permanent employees

- Unit 3 (Faculty):

- Tenured and probationary faculty (Please note: Faculty participating in the Faculty Early Retirement Program (FERP) are eligible for the fee waiver benefit only during the semesters when they are actively employed.)

- Temporary faculty with three-year appointments (pursuant to Article 12 of the CBA)

- Coaches with at least six years of service in the department

- Unit 8 (Public Safety), C99 (Confidential), E99 (Excluded), M98 (Executive):

- Full-time or part-time permanent employees

- Full-time probationary employees

- Temporary employees are not eligible

- Please note: class E99 is not eligible to transfer the benefit to a dependent spouse, child or domestic partner

- M80 (MPP)

- Full-timeemployees(includes temporary)

- Unit 1 (Physicians):

-

Who is eligible to retire?

Employees in the retirement tiers of State Miscellaneous, 2%@55 or 2%@60, may retire with five years of CalPERS service at age 50 years or older. Employees in the new retirement benefit tier of State Miscellaneous, 2%@62, may retire with five years of CalPERS service at age 52 or older. Please access link for detailed information for retirement tiers:

-

Who pays the monthly premium for the CSU Retiree Voluntary Vision Plan or COBRA?

The monthly premium will be fully paid by the enrolled retiree and deducted from their warrant issued by CalPERS.

-

Will I have the same level of medical coverage as a retiree that I had as an active employee?

You and your dependents remain in the Basic medical plan until you and/or your dependents become eligible for Medicare.

-

Are accommodations available for employees with disabilities?

Yes, there are accommodations available for employees with disabilities. To make a request please conact your Department Chair. The Department Chair will then contact the Faculty Personnel Services Office for support in providing possible accommodations.

-

If I feel that I am being harassed in the workplace, who would I contact?

If you feel that you are been harassed in the workplace, please contact...

-

If I feel that I have been discriminated against in the workplace, who do I contact to file a complaint?

To file a complaint, you may contact Suzanne Pasztor sp49@humboldt.edu, extension 3643 or Dale Oliver dale.oliver@humboldt.edu, extension 4921 with information regarding your concern. Any information provided will be kept confidential and it is used to assist staff and faculty with any questions they may have regarding discrimination.

If you want to file a formal complaint, you may contact Scott M. Kasper scott.kasper@humboldt.edu, extension 5174.

-

Do employees need to fill out the Prior Employment section on the EIF, and what does Payroll do with this information?

Yes, they do need to fill this out. This helps identify if an employee has been in the PERS retirement system. However, a Bridge job classification by nature is not eligible for PERS but often times these sign-ups are used should the employee apply for a future position on campus; so the forms should be as complete as possible.

-

What taxes and/or deductions will be taken out of my Summer Bridge pay warrant?

Bridge student workers are exempt from paying into social security but they are required to pay into the Part-Time, Seasonal & Temporary Retirement @ 7.5% and they are required to pay into Medicare @ 1.45%. For additional information on the Part-Time, Seasonal & Temporary Retirement Plan, please see the Savings Plus Benefits Payment Booklet and the Savings Plus Program website.

-

Who picks up the cost when an employee working in multiple departments runs in to overtime for the week?

Currently, Payroll's practice is to notify the department whose hours fell at the end of the week puting the employee in the overtime situation. Kin d of a "last in approach"

-

Who qualifies as a Bridge Student Assistant?

Students must be enrolled in the fall 2023 semester for a minimum of 6 units (undergrad) or 4.5 units (grad). Seniors who will be graduating spring 2023 may work one final Bridge appointment for summer 2023 but must be separated by August 1, 2023.

-

Do I still need to keep track of all of the applicants on the Applicant Log and send them emails acknowledging that I received their application?

You only have to track and send acknowledgements to new applicants to your Temporary Faculty Pool – those who complete the Application for Lecturer Appointment form. You do not have to send out emails or enter on the Applicant Log any incumbent lecturers who request continued employment – those who fill out a Request for Subsequent Lecturer Appointment form.

-

Do lecturers with three-year appointments have to do the Request for Subsequent Lecturer Appointment too?

The Request for Subsequent Lecturer Appointment form is a communication tool between the lecturer and the department. We encourage all incumbent lecturers to complete the form and supply the information the department needs to make course assignments for the next year. For continuing three-year lecturers, filling out the form is not required to maintain their appointment, but it is an easy way to provide the necessary information to the department.

-

What is the recruitment cycle?

The recruitment cycle looks like this:

- A new applicant applies to the pool.

- You enter him/her on the Applicant Log for that year and send out an acknowledgement email.

- If the applicant is hired, s/he becomes an incumbent lecturer, and would complete a Request for Subsequent Appointment in the following academic year.

- Because s/he has already been logged previously as a new applicant, the department does not enter him/her on the log or send an acknowledgement email.

- If the applicant is not hired, the department must keep the application on file for 2 more years.

- Again, since s/he has already been logged as new applicant, the department does not need to do so again.

- If, after the 3rd year, the applicant has not been hired, s/he would have to complete a new application to remain in the pool. ...And the process would start over again.

- If the applicant is hired, s/he becomes an incumbent lecturer, and would complete a Request for Subsequent Appointment in the following academic year.

The process guide (with mail-merge instructions for Microsoft Word 2007 and 2010), along with the sample acknowledgement email and the spreadsheet template are available at the bottom of the Temporary Faculty Unit Employee Pool Recruitment page.

-

Who is considered to be an incumbent lecturer?

If the lecturer taught in the previous academic year – either one or both semesters - and/or has a three- year appointment, he/she is considered an incumbent lecturer.

-

Who should fill out the Application for Lecturer Appointment?

Anyone who is interested in teaching during the upcoming academic year, who is not an incumbent (current) lecturer.

-

Who should fill out the Request for Subsequent Lecturer Appointment?

Any incumbent lecturer who wants to communicate interest in teaching during the upcoming academic year.

-

Can I appeal the result of a Classification Review?

CSUEU employees (Units 2, 5, 7 and 9), CFA employees (Unit 3) and SETC employees (Unit 6) have provisions in their Collective Bargaining Agreements to appeal the result of a Classification Review. Please refer to your Collective Bargaining Agreement for specific details regarding the process and timelines for appeal.

-

How long does it take to receive confirmation of the outcome of a request for Classification Review?

Requests for Classification Review are handled in the order that they are received. Employees can expect to receive a written response detailing the outcome of the review from Human Resources within one hundred and eighty (180) days from the time the request is received in Human Resources.

-

How long does it take to receive confirmation of the outcome of a request for In-Range Progression?

Requests for In-Range Progression are reviewed in the order that they are received. Employees can expect to receive a written response detailing the outcome of the review from Human Resources within ninety (90) days from the time the request is received in Human Resources.

-

How often can a Classification Review be requested for an individual’s position?

A Classification Review can be requested by the employee every twelve (12) months. An appropriate administrator can request a Classification Review on an employee's behalf at any time.

-

How often can an In-Range Progression be requested for an individual’s position?

An In-Range progression can be requested by the employee every twelve (12) months. An appropriate administrator can request an In-Range progression on an employee's behalf at any time.

-

How often should position descriptions be updated?

Most collective bargaining agreements have provisions for the frequency with which position descriptions should be reviewed and updated. In the absence of these provisions, Human Resources recommends that position descriptions be reviewed and updated when a position is vacated and reviewed for recruitment or annually for occupied positions as part of employee performance evaluation process.

-

If my position is reclassified as the result of a Classification Review, do I receive a salary increase?

If an employee's position is reclassified to a classification whose minimum salary is greater than the minimum salary of the previous classification, then the employee will receive the new base salary of the higher classification, or, a minimum of five (5) percent increase to their base salary.

-

If my request for In-Range Progression is approved, when can I expect to see the change in salary?

In most cases, the effective date of the In-Range Progression will be the first day of the pay period following receipt of the request in Human Resources. For example: If a request is received by Human Resources on January 11, 2017 the effective date would be February 1, 2017 which corresponds to the first day of the pay period for February 2017.

-

What is the difference between an In-Range Progression and a Reclassification or In-Classification Progression?

An In-Range Progression is a change in salary within the employee's current classification salary range based on specific criteria defined in the employee's Collective Bargaining Agreement.

A Reclassification is appropriate when a position has changed significantly so as to justify a change in classification. Classifications are defined in the CSU Classification Standards.

In-Classification Progression is appropriate for classifications with defined skill levels or ranges when a position has changed significantly so as to justify progression to the next skill level or range. For example: Progression from Information Technology Consultant – Foundation Level to Information Technology Consultant – Career Level.

-

When is a stipend appropriate?

Please refer to your collective bargaining agreement for specific criteria related to stipends. Some of the more common criteria for stipends include temporary project coordination or lead work functions, additional work or special project, special assignments and POST certification.

-

When should a position description update be requested?

A position description update should be requested any time there is a significant change to a position. This could include changes to the position summary, essential job functions, reporting structure (org chart) or working conditions.

-

Who can request a position description update?

A position description update can be submitted by an employee or by the appropriate administrator. Any changes to a position description will need to be approved by the immediate supervisor and appropriate administrator(s).

-

Who can request a stipend?

Stipends are typically requested by the appropriate administrator on an employee's behalf. The criteria and provisions for stipends vary widely by bargaining unit. Please refer to your collective bargaining agreement to determine if you are eligible to receive a stipend and the specific criteria governing stipends for your unit.

-

Who can request an In-Range Progression?

In most cases, a request for In-Range Progression will be submitted to Human Resources by the appropriate administrator for the department submitting the request. However, UAPD Employees (Unit 1), CSUEU employees (Units 2, 5, 7 and 9) and APC employees (Unit 4) have provisions in their Collective Bargaining Agreements that allow for employee-initiated requests for In-Range Progression. Please refer to your Collective Bargaining Agreement for further details.

-

Does a paper absence sheet still need to be used?

A paper absence sheet will need to be submitted through December 2012 in addition to electronic submission of absences. After that, a paper absence sheet is still needed for certain circumstances such as:

- Reporting a dock by the 15th of the month to avoid overpayment,

- Special leaves being coordinated through the Employee Leaves or Workers’ Compensation programs,

- When adding an absence to a finalized prior period where “No Leave Taken”was initially reported, or

- When deleting an absence from a finalized prior period.

- Academic Year (AY) faculty leave/absence reporting.

- Intermittent Employees Reporting hours worked.

-

How can I tell if I already approved time for an employee?

The status of an absence can be seen through “Report Time > Manager Absence Entry.”

-

How do I correct an absence I have entered?

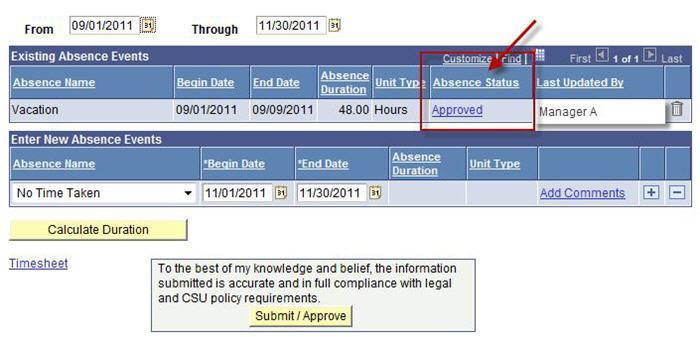

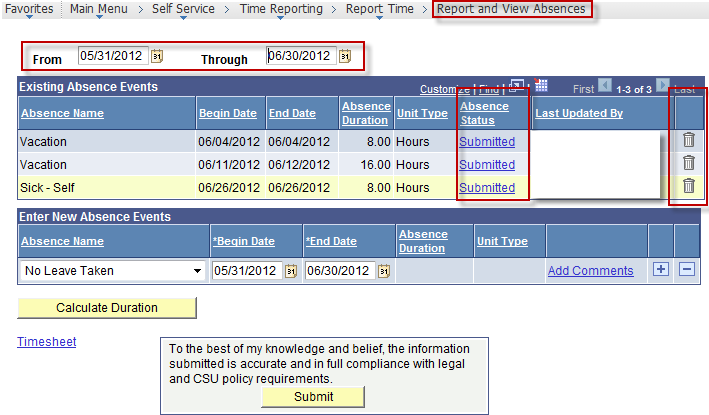

An employee can correct an absence up to the point when the supervisor approves the absence. Simply delete the entry using the trash can symbol. If the supervisor has already approved then the supervisor must delete. When in “Report and View Absences,” make sure that the “From” and “Through” dates are appropriate for the period you are reviewing. Click on the “Absence Status” hyperlink for “Existing Absence Events” to see details about the status.

-

How do I enter an absence for a prior absence period?

- Through AMSS when adding an absence to a period where other absences exit.

- Submit a “Correcting” paper absence sheet that represents all time for the absence period when:

- adding an absence to a period where “No Leave Taken” was used

- trying to delete an absence once the “Absence Status” has changed to“Finalized”

-

How do I see if time was approved and who approved it?

The status of a reported absence can be seen through “Report and View Absences.”Detailed Timekeeper instructions are located in the Timekeeper guide.

-

How do I see the status of the time I have submitted? Has my supervisor approved?

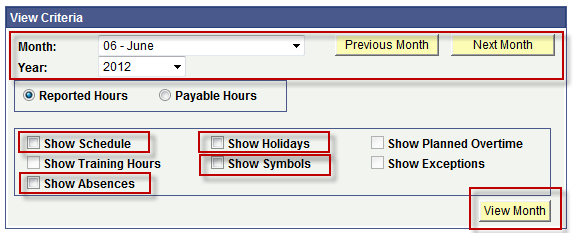

When in “Report and View Absences,” make sure that the “From” and “Through”dates are appropriate for the period you are reviewing. Click on the “Absence Status” hyperlink for “Existing Absence Events” to see details about the status. Every status changes is time stamped and recorded including the supervisor approval of an absence. See the screen shot above.

-

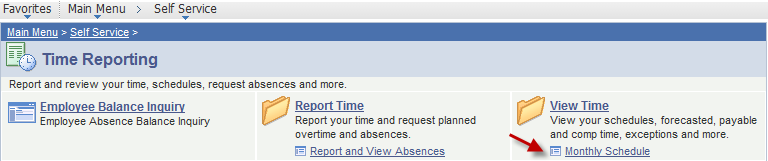

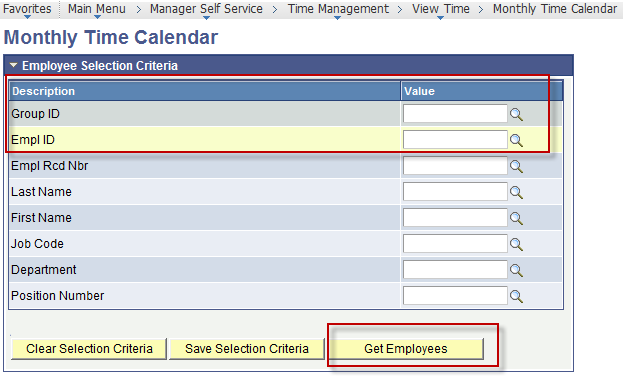

How do I view schedule information for employees?

As a Timekeeper you have the ability to view schedules and absence takes using the Time Calendar. It is recommended that you use the "Monthly Time Calendar" and view by either Empl ID or Group ID. Group IDs with an "A" will include absence management eligible employees. Group IDs with and "X" will include student employees. This page uses dynamic group security so entering a Department ID as a search criteria will bring back both student and staff records and is not recommended. Also note that the sum of absences as well as hours scheduled is for calendar month rather than pay period and if selected will include 24-hour holiday periods.

-

What is the difference between “Approve Reported Absences” and “Approve Time and Absences?”

There is currently no difference. The “Approve Reported Absences” page will be going away.

-

Why can't I access my information in Manager Self Service?

To view your personal absence information, use the Self Service link. To view absence information for your direct reports, use the Manager Self Service link.

-

Why does the “Current Period Absence” column say “Sub” (submitted) when all absences have been approved for the current period?

“Current” to the system means most recently entered. The column really looks at the most recent absence entered and considers this entry as current. The entry could be 2 months into the future. If you are using this field to double check that a specific month’s time has been approved, you will need to click on the details located in the Report and View Absences page for any marked as submitted to verify it is the correct month.

-

Why don't I see Manager Self Service when I log into PeopleSoft?

The Supervisor/Manager role has been moved to Self Service. This can now be accessed through the portal in the same way that employee entry is accessed.

-

Why isn’t the “Absence Duration” correct for a full-day absence?

The Absence Management system requires input of schedules to determine absence reporting on specific days. The Absence Management system defines a schedule as the number of hours worked on specific days during the week. If your schedule is incorrect in the system then the absence duration will not be correct. View your schedule then submit a Notice of Work Schedule form if a change is needed.

-

Am I required to wear a face covering if I am on campus?

Face coverings must be worn by anyone who enters an indoor facility other than their residence, or while outdoors when the person is unable to maintain a six-foot distance from another person at all times, beginning Friday, April 24, per the most recent Humboldt County Public Health Order. View the county order here.

This applies to anyone making essential trips to the Humboldt campus.

For guidance about face coverings and instructions on how to make your own face coverings, visit the CDC website.

If wearing a face covering while at work would create a safety hazard, please speak directly with your supervisor to discuss accommodation. This guidance does not apply to employees requiring the use of other specific face coverings for their job type.

Please continue to follow the county’s shelter in place mandate. The best precautions against COVID-19 are still practicing good hand hygiene, keeping all surfaces disinfected, staying at home, and modeling social distancing when doing essential tasks away from home.

-

Are background checks still being processed?

Background checks ordered through Accurate are being processed, but they are contingent upon the status of the verifying agency. Many background checks have been cancelled due to COVID-19 related agency closures. Please note that despite these cancellations, per the CSU Background Check Policy, background checks should still be completed prior to an appointment being finalized and the candidate beginning work in the new position. Please contact Background Check Coordinator Nicole Log at nicole.log@humboldt.edu if a background check is unable to be completed.

-

Are we allowed to hire new employees at this time?

COVID-19 has impacted the availability of candidates as well as the employees serving on search committees. As such, Committee Chairs should reach out to their appropriate Vice President to determine whether specific searches are moving forward or are suspended.

-

Can employees and student workers complete hiring paperwork through HR without visiting campus?

Human Resources has moved to virtual operations. HR employees are available from 8am-5pm Monday through Friday to answer all your questions via phone or email. You can make a virtual appointment with us by emailing hr@humboldt.edu. Please find contact information for all HR employees, and their areas of expertise, by visiting the Human Resources Staff Directory.

-

Can I be reimbursed for using my personal phone, internet and home printer while I work from home?

Employees are currently not being reimbursed for any incidental costs for working at home.

-

Can my appropriate administrator make me come to campus to work?

Employees who are essential to maintaining critical services on campus must report to campus as required by their appropriate administrator. This limited number of employees will be on campus to ensure business continuity of the critical services. All staff whose work is not essential to maintaining business continuity on campus should telecommute until further notice.

-

Do Faculty need to telecommute?

Faculty began telecommuting and teaching from home no later than Thursday, March 26 (Note: Faculty do not need to submit the telecommuting agreement). TAs who are an instructor of record should follow protocols similar to faculty as far as moving their courses to a virtual format. They should consult with their department chair and faculty for assistance. Humboldt’s Information Technology Services and Center for Teaching and Learning have been working hard to help the campus switch to alternate modes of instruction. Please consult the Working from Home and Keep Teaching website for all of the latest information.

-

Have there been any changes to what is an allowable expense for my Health Care Reimbursement Account (HCRA) related to COVID-19?

Yes, there have been some changes made to allowable expenses. Please visit Humboldt’s Flexible Spending web page for more details.

-

How can I minimize my risk of contracting COVID-19?

Employees are encouraged to carefully follow CDC guidelines, as well as national, state and local directives to mitigate their risk of contracting COVID-19. You may also find additional information in the Guidelines for Events, Meetings, and Social Distancing.

-

How do I claim COVID-19 Related Leave in Absence Management?

For appointed staff utilizing COVID-19 Paid Administrative Leave please enter time used by selecting CPAL/FFCRA from the drop down. Then in the comments you must type the following, depending on the type of leave you are using:

CPAL- Coronavirus Admin Leave

NTWL- Non Telecommute Workers Leave

FFCRA-Family First Coronavirus Response ActThis will also need to be followed up with the request form

When using the "new" PAL/FFCRA leave type in Self Service, there's a warning message which states that "use of this leave type requires certification". The message is just a warning; if employees click "OK", they can still submit the leave.

-

How do I enroll in direct deposit?

Employees who wish to enroll in the program must complete form STD 699, Direct Deposit Authorization Form. This enrollment form includes the following banking information:

- Type of Account (checking or savings)

- Routing Number (9-digit bank transit number normally located in the bottom left corner of your check)

- Depositor Account Number

In order to ensure that the correct data is entered on the form, you may wish to verify the above information with your financial institution prior to submitting the form to the University Payroll Office. Due to the sensitive nature of this information, please contact paa7001@humboldt.edu regarding delivery.

Your personnel/payroll office will verify your form for completeness and send it to the State Controller's Office (SCO) for processing. Once the SCO verifies that you have an active account at your designated financial institution, all payments you receive through the payroll system (e.g., regular pay, overtime, adjustments, etc.) will be made by direct deposit. Be advised, it will take 30 to 45 days for this process.

-

How do I file for Unemployment Insurance?

Individuals who want to learn more about filing for Unemployment Insurance should visit the EDD website.

-

How do I obtain a copy of my 2019 W-2 and copies of my paycheck stubs?

As a California State University (CSU) employee, your pay check/direct deposit advice and annual W-2 are issued (hard copy) by the State Controller’s Office (SCO). These hard copy documents have been the only means made available to you by the SCO as a record of your earnings, until now.

Cal Poly Humboldt employees now have the opportunity to access this information through Cal Employee Connect.

The State Controller’s Office (SCO) has produced a tool that will allow employees to view their earnings statements and W-2’s, along with personal information. Cal Employee Connect will ultimately reduce state costs and workload by providing a tool for all state employees to access their information electronically.

- Have a recent paper pay stub in hand. It has information you will need that is not available from Payroll; you must be a state-side employee.

- Go to Cal Employee Connect Select Register.

- Follow the prompts with these helpful tips:

- Select the Department "CSU - Humboldt"

- Enter the Agency Code "225"

- Enter the Earnings Statement Number of the pay stub from step 1. If using the View Paycheck feature in myHR, this number is referred to as the Warrant #. You will need to enter this number with a leading zero and in the format shown in CEC

- Enter the Total Deductions on the pay stub from step 1. If using the View Paycheck feature in myHR add “Total Taxes” and “Total Deductions” together to get the deduction total needed for the verification

- Once registered, you will be able to login to view and print your earnings statements/paychecks: current tax year and 2 tax years prior and view and print W-2 information: 3 years are available

-

How do I review and update my beneficiaries on my Life and AD&D insurance accounts and/or CalPERS retirement account?

Beneficiary updates must be made directly with the provider. For Life and AD&D insurance, contact The Standard at https://www.standard.com/mybenefits/csu/life_add.htmlor 800-378-5745. For CalPERS, log in to my.calpers.ca.govor call 888-225-7377.

-

How do I submit a timesheet if I cannot come onto campus?

Student and Intermittent hourly employees are being directed to reach out to your department coordinators who will be collecting all hours worked and submitting them to the payroll department per the instructions on our website.

-

How is Humboldt addressing ongoing staff and MPP recruitments?

The guiding principles for completing recruitments are to provide a fair and equitable search process for all applicants.

For staff and MPP searches:

- All Hiring Authorities should contact their Vice Presidents to determine which recruitments have been deemed “essential” and should continue. All searches deemed “non-essential” should be suspended until further notice and HR will notify any affected applicants.

- For searches deemed essential:

- Search committees should developan online strategy for virtual interviews (e.g. Zoom) that provide a reasonable facsimile to a live interview for each candidate, while retaining the elements most important to assessing each candidate’s ability to succeed on campus and meet the stated requirements of the position. At no point should the search committee conduct an in-person interview, all interviews should be conducted virtually.If the committee is not confident that the goals above can be accomplished, the search committeeshould discuss with the Hiring Authority and consider extending the search.

- For searches where some candidates have already visited campus and it is necessary to hold the remaining interviews using online strategies, the committee should design a reasonable facsimile to a live interview (see above) for the remaining candidates.

*For information regarding current faculty recruitments, contact Academic Personnel Services at aps@humboldt.edu.

-

How many hours can I work right now?

Student Employees may work up to 20 hours per week during school sessions without negatively impacting their financial aid. Contact your appropriate administrator with questions regarding your schedule.

All other staff work their regular schedule. As usual, employees may not work overtime without approval of their appropriate administrator.

-

How should employees enter work time or absences if working remotely?

Employees should utilize Peoplesoft self-service to record their time worked or absences as normal. The system may be accessed through any computer or mobile app with internet capability. Additionally, an employee’s manager has the authority and ability to enter the employee’s time.

-

How will hourly intermittent employees be paid?

Hourly intermittent employees will only be paid for time worked. These employees are not eligible for COVID-19 Paid Administrative Leave.

-

How will I get paid for my work if I am an intermittent hourly worker and cannot do my work remotely?

Intermittent hourly employees who are unable to return to work either in person or remotely will not be paid.

-

I am a student employee. Can I be reassigned on campus to do other work?

Yes, student employees may be reassigned to a position that has the same funding source. Academic Student Employees (Unit 11 ISAs, GAs, TAs) should continue to perform the work for which they were appointed (or similar work) and at their appointed time base. They should work closely with their appropriate administrator to determine their responsibilities while telecommuting.

-

I am a student employee. Can I keep working?

Student Employees should continue to perform the work for which they were appointed (or similar work) and at their appointed time base. If their appropriate administrator is not able to transition job functions to telecommuting, students will continue to be paid for their regularly scheduled time. Student employees who are telecommuting should read the guidelines on telecommuting for staff and managers and complete the telecommuting form.

-

I can’t come onto campus and I do not have Direct Deposit. How do I get my paycheck?

For those who are unable to return to campus on check distribution days, the University can mail state paychecks to intended recipients.

Please email Humboldt-cash@humboldt.edu if you would like your paycheck mailed to you, as we need your authorization. Please include your mailing address in the email and we will verify that against the current address on record in your PeopleSoft Human Resources account.

-

Is Live Scan still available at UPD?

Live Scan services are currently available to campus community members (faculty, staff, students, etc.) through the University Police Department. The live scan form required to complete live scan services can be found on the HR Forms website. In the event that live scans are no longer being provided on-campus, other agencies in Humboldt County may still be providing Live Scan services. Calling the agency ahead of time is recommended. Candidates may be required to pay for the live scan at the time of service, but should work with their hiring departments to arrange reimbursement. Please note that despite these closures, per the CSU Background Check Policy, background checks (including Live Scans, if applicable) should be completed prior to an appointment being finalized and the candidate beginning work in the new position. Please contact Background Check Coordinator Nicole Log at nicole.log@humboldt.edu if a live scan is unable to be completed.

-

Is there training available to help me learn how to work effectively from home?

Yes! Visit the Training website for online courses and other resources to help you work successfully with your virtual team and maintain your well-being.

-

May employees utilize professional development coursework as remote work assignments?

Employees are allowed to complete any/all required online training as well as other developmental online learning during this time period in which they are working remotely. Employees should communicate with their Appropriate Administrator or immediate supervisor prior to completing non-mandatory online learning. Visit the Humboldt Training website to find a variety of online learning opportunities.

-

Should student employees still come in to work?

Student employees whose work is not essential to critical operations of the campus are to telecommute, at the direction of their appropriate administrator. Please continue to work with your appropriate administrator on your work assignments and technology support needs.

-

What are Humboldt’s telecommuting policies for employees?

All employees, including student employees, who are telecommuting should review and complete the Temporary Telecommuting Agreement.

-

What does it mean to self-quarantine?

The CDC says, "Quarantine is used to keep someone who might have been exposed to COVID-19 away from others. Someone in self-quarantine stays separated from others, and they limit movement outside of their home or current place. A person may have been exposed to the virus without knowing it (for example, when traveling or out in the community), or they could have the virus without feeling symptoms. Quarantine helps limit further spread of COVID-19."

-

What does it mean to self-quarantine?

Employees who confirm exposure or contraction of COVID-19 should self-quarantine for a 14-day period. This means the employee should stay at home and limit contact with others.

-

What if an essential employee fails to comply with directives from their appropriate administrator?

In the absence of reasonable safety or legal reasons, employees must follow the directives of their appropriate administrators or they will be considered to be insubordinate. Insubordination may result in disciplinary action up to and including termination.

-

What if I need to care for someone at home that is self-quarantining but not officially diagnosed with COVID-19?

Employees who show no signs of illness, but report the need to care for a family member at home who is in self-quarantine should seek the advice from their healthcare provider and local health officials. Such employees may use their available leave credits include the 256 hours of COVID-19 Paid Administrative Leave when telecommuting is not possible.

-

What if I need to care for someone at home who has been diagnosed with COVID-19?

Employees who show no signs of illness, but need to care for a family member at home who is diagnosed with COVID-19, may use their available leave credits including the 256 hours of COVID-19 Paid Administrative Leave to cover their period of absence when telecommuting is not an option. If the family member is someone the employee would typically be able to use sick leave for, then the employee may also be eligible for catastrophic leave, NDI, and FMLA at a future time.

-

What if I or someone in my household has recently travelled outside of Humboldt County?

Travel to areas with community level transmission of COVID-19 increases the risk of exposure and transmission to our campus and local community. In the interest of protecting our students, staff, faculty, and local community, and to decrease the likelihood of occupational transmission, Cal Poly Humboldt is directing the following of employees who are working on campus:

As of Friday, March 27, if you have returned to the county (flying or driving) after visiting an area with community level spread or you live with someone who has been diagnosed or is suspected to have COVID-19, you must notify your appropriate administrator immediately. It will be necessary for you to self-quarantine at home for 14 days. Your appropriate administrator will work with you to identify if there is any telework available. If someone you live with has traveled and you have not, you must notify Human Resources (HR) at (707) 826-3626 for individual case review.

-

What if my child(ren)’s school or day care has closed due to concerns related to COVID-19?

Employees who show no signs of illness, but report that their child(ren)’s school or day care as closed due to concerns related to COVID-19, may use their available leave credits including the 256 hours of COVID-19 Paid Administrative Leave (CPAL) when telecommuting is not an option or cannot be carried out in conjunction with the childcare commitment.

-

What is open, when, and for whom?

This situation is evolving. Please contact departments with which you need to connect directly. Utilize the campus directory to find those with whom you wish to connect. Campus is closed to the general public until further notice.

-

What is the campus doing to reduce my risk of contracting COVID-19 while I am required to work on campus?

The health and safety of all our employees is one of the main priorities during this time. Employees working on campus should continue to use social distancing and hygienic precautions such as washing their hands frequently. The university will work to ensure that employees reporting to campus will have easy access to hand washing facilities and/or hand sanitizer and be able to practice social distancing in their workspace. Please contact your appropriate administrator or any department-specific exposure mitigation measures. For more information please click on the following link: Guidelines on Events, Meetings, and Social Distancing.

You can also learn more by taking this COVID-19 Social Distancing Guidelines Course in CSULearn.

-

What leave options do I have related to COVID-19?

In response to COVID-19, multiple leave options have been enacted to help employees who are affected by the pandemic. The language and provisions differ slightly, but the intent of the programs are the same - to provide paid leave to employees for COVID-19 related reasons. Visit the HR Leave & Disability web page for details.

If you work for an Auxiliary (SPF, University Center and Associated Students) and have any questions regarding leave options, please contact your Appropriate Administrator or your administrative office.

-

What other types of leave are available to employees?

Employees who are not eligible for the COVID-19-related leave as outlined here, have exhausted that leave, or who will be out for medical reasons not related to COVID-19, still have their personal leave available and may have other leave options.

Please contact Benefits in HR at mca33@humboldt.edu for any questions regarding leave types.

-

What resources are available to me if I think I or a family member at home has either been exposed or contracted COVID-19

Employees are encouraged to review CDC guidelines regarding what to do if they believe they may be ill with COVID-19, including contacting their health care providers for assessment.

Your insurance may provide no-cost services for testing and treatment. The following information is subject to change - you should check your insurance company’s website for the most current information.

Anthem (Pers Choice, Pers Select, Pers Care, Traditional HMO): All cost-sharing for screening and testing, including hospital/emergency room, urgent care, and provider office visits for the purpose of screening and/or testing for COVID-19 is being waived. You also have access to no-cost online doctor visits using LiveHealth Online.

Additional special resources for Anthem members can be found at the Anthem COVID-19 website.

Blue Shield of California: The costs of COVID-19 tests recommended by a doctor will be covered and out-of-pocket costs (copays, coinsurance, and deductibles) will be waived for for:

- Doctor visits for screenings

- Emergency room (ER) or hospital visits for screenings

- Urgent care visits for screening

- Through May 31, Blue Shield is covering your costs for Teladoc visits. With Teladoc, you can talk to a doctor 24/7 by phone or video to screen about COVID-19. Learn how Teladoc can help.

- Via NurseHelp 24/7 you can talk with a registered nurse anytime at no additional cost.

-

What resources are available to me to support my mental health?

Humboldt employees have access to the Employee Assistance Program (EAP), provided through Humboldt Family Service Center. They are currently using telehealth for their appointments.

Employees also have access to mental health services through their health plans. The best way to find a provider is to use the "find a doctor" tool on the Anthem website or the Blue Shield website.

Additional special resources for Anthem members can be found at the Anthem COVID-19 website.

While employees are not eligible to use Humboldt's Student Health and Counseling Services, employees may find the links and resources available on their website helpful.

Mental health issues related to COVID-19 may be qualifying events for COVID-19 Paid Administrative Leave (CPAL). For more information visit the CPAL webpage.

-

What should I do if I have actually contracted COVID-19?

Employees should immediately contact their health care provider and health officials and are not to report to campus if working on-site. Such employees may use their available leave credits including the 256 hours of COVID-19 Paid Administrative Leave to cover their period of absence. These employees may also apply for catastrophic leave, NDI, and FMLA at a future time. Employees should not return to work until they have received certification, from their health care provider, that it is okay to return.

-

What should I do if I think I may have been exposed to COVID-19?

Employees who show no signs of illness but are concerned about previous exposure (and that exposure is unconfirmed) should speak with their appropriate administrator to discuss telecommuting. Such employees may use their available leave credits including the 256 hours of COVID-19 Paid Administrative Leave to cover their period of absence when telecommuting is not an option.

-

Which employees are NOT allowed to be on campus right now?

Employees, including students, who are 65 years old or older and/or have an underlying health condition that make them vulnerable to the COVID-19 virus are prohibited from coming onto campus and are strongly advised to self-quarantine during this time. Please visit the Center for Disease Control website for more information regarding underlying health conditions here.

-

Who can or should be working on campus at this time?

Only employees who are essential to maintaining critical campus operations should be working on campus. If you are unsure if you need to work on campus, please check with your appropriate administrator.

-

Who do I contact for support?

Humboldt, Sponsored Program Foundation (SPF), and Associated Student (AS) Employees

Human Resources

Email: hr@humboldt.edu / Phone: (707) 826-3626 / Fax: (707) 826-3625Payroll

Email: payroll@humboldt.edu / Phone: (707) 826-4918Faculty and Academic Student Employees (Unit 11 ISAs, GAs, and TAs)

Academic Personnel Services (APS)

Email: aps@humboldt.edu / Phone: (707) 826-5086University Center (UC) Employees

Email: uchr@humboldt.edu / Phone: (707) 826-5982 -

Who should be telecommuting and what does it require?

All staff not identified as essential for critical functions on campus should telecommute given the order from the Governor for all California residents to shelter in place. If you have any questions about telecommuting, please contact your appropriate administrator. The ITS website has multiple resources for working from home.

-

Will I be reimbursed for any incidental costs related to working remotely or telecommuting?

You will be solely responsible for the configuration of and all of the expenses associated with your telecommuting workspace and all services unless the MBU lead, in consultation with the appropriate service unit (e.g. ITS, HR), expressly agrees otherwise. This includes ensuring and maintaining an ergonomically appropriate and safe telecommuting worksite.

-

Will I be reimbursed for parking that I have paid for?

Starting with the May 1 paycheck, monthly payroll deductions for staff and faculty parking permits will be suspended until further notice.

Staff and faculty who purchased a Spring parking permit will automatically be refunded 25% of the purchased price. Please allow 2-4 weeks for refunds to be processed. You will receive an email from the Humboldt Cashier’s Office when your refund has been processed.

-

Will student employees continue to be paid?

Through May 15, 2020, all student employees will continue to be paid for their regularly scheduled time. For example, if you are scheduled to work every Monday and Wednesday, 10 a.m. to 2 p.m., you will continue to be paid for those hours even if you are unable to come in. Thereafter, student employees are eligible for the temporary COVID-19 Paid Administrative Leave. You can find more information on this by following this link.

-

Will the Humboldt campus remain open?

Cal Poly Humboldt is open but has transitioned to virtual operations. Campus is closed to the general public, until further notice, as part of social distancing efforts.